Bank of Canada interest rate

Take a central role at the Bank of Canada with our current opportunities and scholarships. The Bank of Canada is set to raise its overnight rate by a hefty 75 basis points this month and by another 50 in September front-loading.

Despite Trade Threats Canadian Home Buyers Must Plan For Still Higher Rates Don Pittis Cbc News

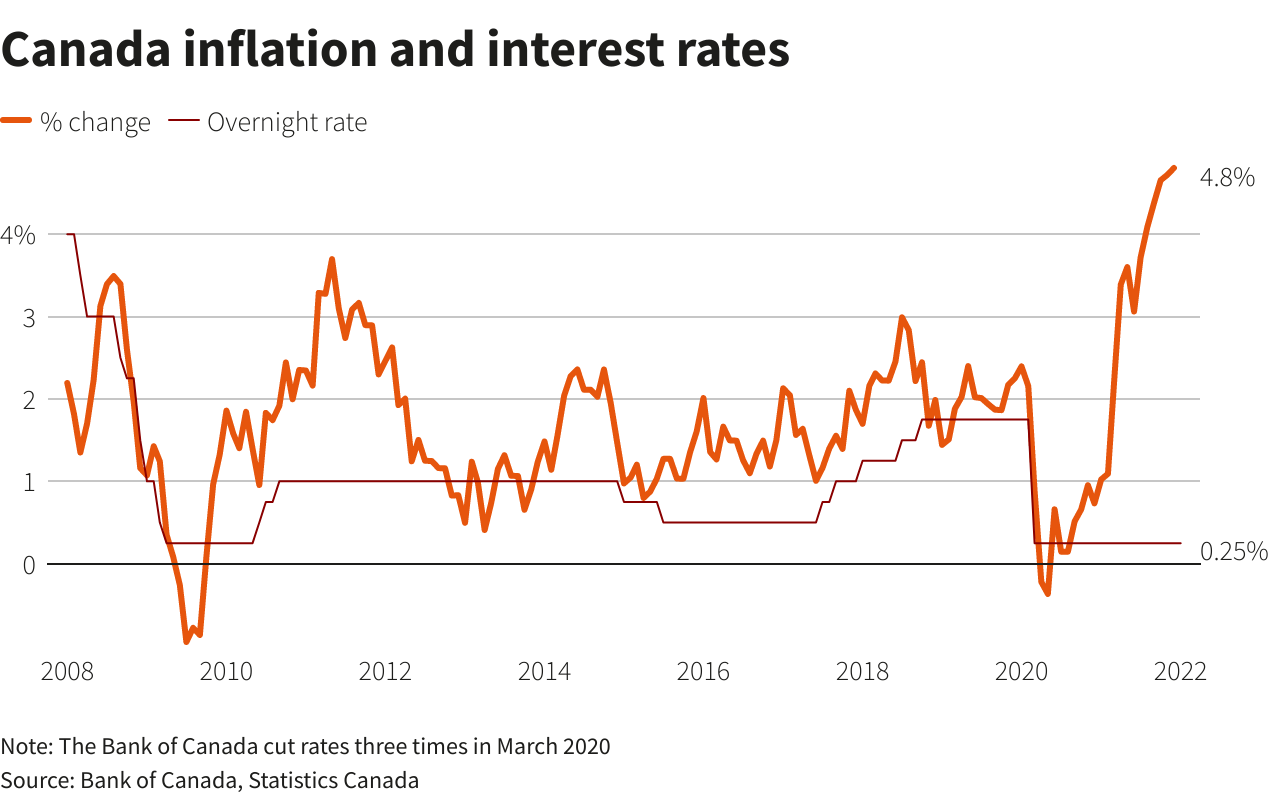

Analysts expect the bank will increase the rate by 075 pushing it from 15 to 225 marking the fourth consecutive increase this year after a two-year pandemic-time low rate of 025.

. Date Target Change June 1 2022. Our renewed monetary policy framework In 2021 we renewed Canadas flexible inflation-targeting framework for 2022 to 2026. 1 day agoThe Bank of Canada raised its key interest rate by half a percentage point on June 1 bringing it to 15 per cent.

Target for the Overnight Rate. 18 hours agoThe Bank of Canadas largest interest rate hike in 2022 is expected to be made this week and it could be the largest one yet this year. The Bank of Canada raised its key interest rate by half a percentage point on June 1 bringing it to 15 per cent.

The predicted hike is said to rein in the growing inflation as central bank. See the Nations Top Bank Savings and Money Market Accounts. Ad Ratezip Helps You Compare Online Savings Accounts.

How does the Bank of Canada raising the interest rate affect your mortgage. The Bank of Canada raised the target for its overnight rate by 50bps to 15 on June 1st 2022 matching market expectations and signaled that it will hike interest rates further in the coming meeting to curb rising inflation. Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada.

For more information on the policy interest rate see this explainer. A homeowner with a variable rate of 27 on a 700000 home that has a 2801 monthly payment now would see their payment rise to 3038 an increase of 237 per month. Bond markets are pricing in more rate hikes in 2022 the TD and National Bank forecasts are the most optimistic for the economy and project the Bank of Canada target rate could reach 325 by.

According to comparison website Finders pooling. The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products. The Bank will also publish its quarterly Monetary Policy Report MPR at the same time as the rate decision.

A row of townhouses in Vancouver. This half a percentage point hike follows up on the Banks April 2022 rate hike announcement of 50 basis points which was the largest individual rate hike since 2000. 1 day agoThe Bank of Canada raised its key interest rate by half a percentage point on June 1 bringing it to 15 per cent.

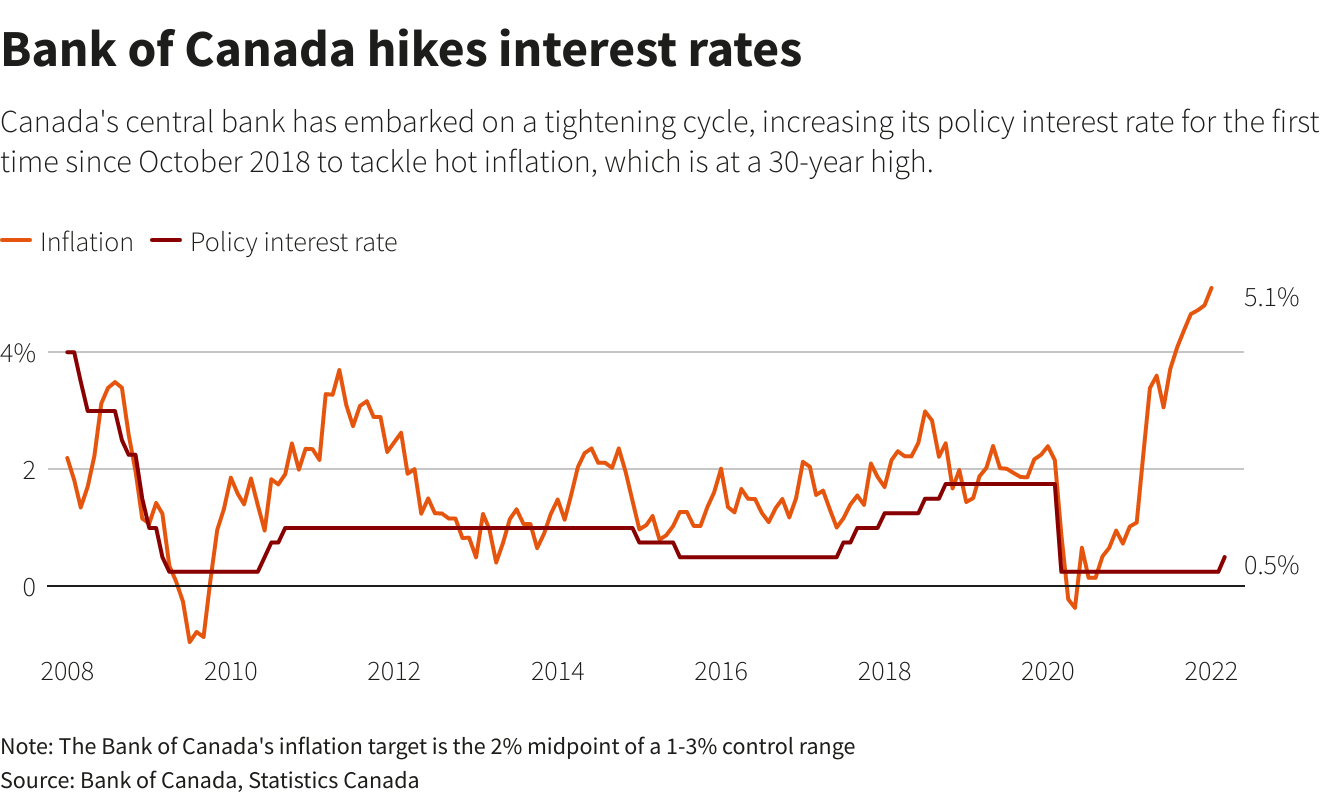

The Bank of Canada today increased its target for the overnight rate to 1½ with the Bank Rate at 1¾ and the deposit rate at 1½. The Bank of Canada implemented a third rate hike for 2022 this month but is expected to increase its key interest rate by 75 basis points on July 13 2022. 20 hours agoIn Canada inflation hit a 39-year-high of 77 per cent in May well above the two per cent target rate central banks typically aim for.

All Bank of Canada exchange rates are indicative rates only obtained from averages of aggregated price quotes from financial institutions. The Bank of Canada raised its benchmark interest rate by half a percentage point to 15 per cent on Wednesday and signalled that more hikes are on the way. Bank of Canada releases interest rate decision and Monetary Policy Report 1000 plus 1100 news conference Organization for Economic Co-operation and Development Secretary-General Mathias Cormann addresses Conference of Montreal 1230 US.

Ad Personalized Insights And Guidance To Help You Stay On Top Of Your Finances. The Bank of Canada BoC has continued raising short-term interest rates as a result of a brighter outlook for the Canadian economy and high inflation. 20 hours agoThe last time the Bank of Canada raised the rates by a half percentage point was 20 years ago.

The pace of further increases in the policy rate will be guided. 1 hour agoThe Bank of Canada is set to deliver a super-sized interest rate hike this week as it accelerates efforts to withdraw stimulus from an overheated. July 13 2022.

16 hours agoEconomists predict Bank of Canada will hike key interest rate by 075 per cent on Wednesday The housing market is flashing deeper signs of strain with sales falling fast and prices poised to. Since then it has signalled a willingness to move in a more aggressive direction. Since then it has signalled a.

The Bank of Canada increased its key interest rate by 50 basis points on June 1 2022 bringing the central banks policy rate to 150. Since then it has signalled a. OTTAWA On Wednesday July 13 2022 the Bank of Canada will announce its decision on the target for the overnight rate.

Real estate values and REIT valuations can come down as a result. 3 hours agoBay Street analysts broadly anticipate the Bank of Canada will raise its overnight interest rate by 075 of a percentage point on Wednesday bringing its policy rate to. Interest Rate in Canada averaged 579 percent from 1990 until 2022 reaching an all time high of 16 percent in.

Economists believe that the forecasted 075 interest rate hike follows the US Federal Reserves own increase of 75 basis points in June its biggest hike since 1994. 1 day agoIf the Bank of Canada hikes its overnight rate by 75 bps to 225 prime rates are expected to rise to 445 putting variable rates at 345 and above said LowestRatesca. Shutterstock Three more overnight interest rate increases by the Bank of Canada BoC can be expected before the end of 2022 which will have ripple effects across the Canadian economy including housing demand and prices.

The policy interest rate remains the Banks primary monetary policy instrument with quantitative tightening acting as a complementary tool. Federal Reserve releases Beige Book 1400 International Energy Agency releases monthly oil market report. Checking Credit Cards More Digital Tools So Impressive You Just Cant Stop Banking.

Jun 1 2022 533 pm. The Bank of Canadas strategy of rapidly increasing its key interest rate in an effort to tackle skyrocketing inflation will likely trigger a recession a. A press release will provide a brief explanation of the decision.

Bank Of Canada Expected To Make Sharpest Interest Rate Increase Since 1998 The Globe And Mail

Bank Of Canada Signals Hikes Coming Soon Leaves Key Interest Rate Unchanged Reuters

Holding Interest Rates Steady Bank Of Canada Keeps The Door Open For A Cut The Real Economy Blog

Bank Of Canada Holds Rate Steady Saying Covid 19 Economic Impact Appears To Have Peaked Cbc News

Canada Interest Rate 2022 Data 1990 2021 Historical 2023 Forecast Calendar

Interest Rates Are Going To Go Crazy Soon

Bank Of Canada Hikes Interest Rates Sets Stage For More Tightening Reuters

:format(webp)/https://www.thestar.com/content/dam/thestar/business/2022/07/12/the-bank-of-canada-is-expected-to-hike-interest-rates-this-week-what-will-that-mean-for-home-prices-and-mortgages/rate_hike.jpg)

Post a Comment

Post a Comment